The key contents of the Ordinance on Sanctions of Administrative Violations in the field of State Audit

The Ordinance on Sanctions of Administrative Violations in the field of State Audit, which was approved by the 15th Standing Committee of the National Assembly (NA) at the 20th meeting session on February 28, 2023, consists of 5 chapters, 21 articles regulating violations, forms and levels of sanction, measures to address consequences; authority, procedures for imposing penalties, executing penalty decisions, and enforcing administrative penalty decisions for violations in the field of state audit.

The key contents of the Ordinance on Sanctions of Administrative Violations in the field of State Audit

Date of effects: the 1st May 2023

Drafting agency: the State Audit Office of Viet Nam

Apprasing agency: the Legal Affairs Committee of the National Assembly

The Ordinance on Sanctions of Administrative Violations in the field of State Audit was approved by the 15th Standing Committee of the National Assembly at its 20th meeting session (dated February 28, 2023). The Ordinance consists of 5 chapters, 21 articles regulating violations, forms and levels of sanction and remedial measures; authority to pose sanctions and procedures for posing sanctions, enforcement of sanctioning decisions and coercive enforcement of sanctioning decisions.

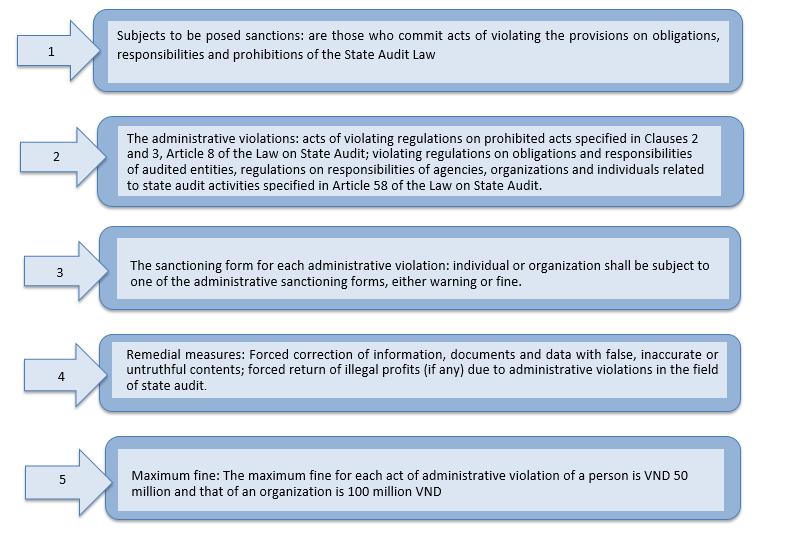

1. Subjects fined for administrative violations in the field of state audit: entities that violate the obligations, responsibilities, and prohibitions of the Law on State Audit

2. Administrative violations in the field of state audit: violating regulations on prohibited acts as stipulated in clause 2 and clause 3 of Article 8 of the Law on State Audit; violating regulations on the responsibility of audited units as stipulated in Article 57 and Article 58 of the Law on State Audit; violating regulations on the responsibility of organizations and individuals involved in state audit activities as stipulated in Article 68 of the Law on State Audit.

3. Forms of administrative penalties for each administrative violation in the state audit field: individuals and organizations that violate must be subject to one of the following administrative penalties, including warnings and fines.

4. In terms of measures to remedy consequences: the law stipulates two measures to remedy consequences, including compulsory correction of information, documents and data with distorted, inaccurate, or dishonest content, and compulsory payment of illegal profits (if any) due to administrative violations in the field of state audit.

5. In terms of fines and the authority to impose fines: the maximum fine for each administrative violation in the field of state audit for individuals is 50 million VND; the maximum fine for each administrative violation in the field of state audit for organizations is 100 million VND.

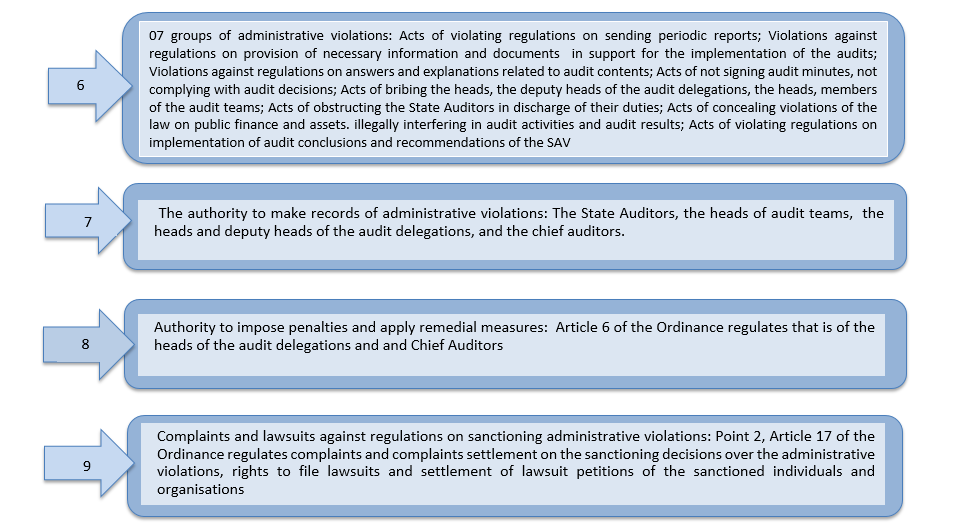

6. 07 types of behaviors that violate regulations in the field of state audit: acts of violating regulations on submitting periodic reports; acts of violating regulations on providing necessary information and documents for auditing; acts of violating regulations on responding and explaining related to auditing content; acts of not signing audit records and not complying with audit decisions; Acts of bribing members of the audit team, obstructing the work of state audit; acts of concealing violations of the law on public finance, public assets, intervening illegally in auditing activities, auditing results; acs of violating regulations on implementing the audit conclusions and recommendations of the state audit.

7. The authority to make administrative violation records: state auditors, head of audit team, deputy head of audit delegation, head of audit delegation, chief auditor.

8. Authority to impose fines and apply measures to remedy consequences: Article 16 of the law provides for the authority of the head of the audit delegation and the chief auditor in imposing fines and applying measures to remedy consequences.

9. In terms of filing complaints and lawsuits regarding administrative violations in the field of state audit: Article 7, Clause 2 of the law regulates the procedures for filing and resolving complaints against administrative penalties, as well as the rights to institute a lawsuit and resolve complaints of individuals and organizations that have been penalized.

Date of effects: the 1st May 2023

Drafting agency: the State Audit Office of Viet Nam

Apprasing agency: the Legal Affairs Committee of the National Assembly

The Ordinance on Sanctions of Administrative Violations in the field of State Audit was approved by the 15th Standing Committee of the National Assembly at its 20th meeting session (dated February 28, 2023). The Ordinance consists of 5 chapters, 21 articles regulating violations, forms and levels of sanction and remedial measures; authority to pose sanctions and procedures for posing sanctions, enforcement of sanctioning decisions and coercive enforcement of sanctioning decisions.

1. Subjects fined for administrative violations in the field of state audit: entities that violate the obligations, responsibilities, and prohibitions of the Law on State Audit

2. Administrative violations in the field of state audit: violating regulations on prohibited acts as stipulated in clause 2 and clause 3 of Article 8 of the Law on State Audit; violating regulations on the responsibility of audited units as stipulated in Article 57 and Article 58 of the Law on State Audit; violating regulations on the responsibility of organizations and individuals involved in state audit activities as stipulated in Article 68 of the Law on State Audit.

3. Forms of administrative penalties for each administrative violation in the state audit field: individuals and organizations that violate must be subject to one of the following administrative penalties, including warnings and fines.

4. In terms of measures to remedy consequences: the law stipulates two measures to remedy consequences, including compulsory correction of information, documents and data with distorted, inaccurate, or dishonest content, and compulsory payment of illegal profits (if any) due to administrative violations in the field of state audit.

5. In terms of fines and the authority to impose fines: the maximum fine for each administrative violation in the field of state audit for individuals is 50 million VND; the maximum fine for each administrative violation in the field of state audit for organizations is 100 million VND.

6. 07 types of behaviors that violate regulations in the field of state audit: acts of violating regulations on submitting periodic reports; acts of violating regulations on providing necessary information and documents for auditing; acts of violating regulations on responding and explaining related to auditing content; acts of not signing audit records and not complying with audit decisions; Acts of bribing members of the audit team, obstructing the work of state audit; acts of concealing violations of the law on public finance, public assets, intervening illegally in auditing activities, auditing results; acs of violating regulations on implementing the audit conclusions and recommendations of the state audit.

7. The authority to make administrative violation records: state auditors, head of audit team, deputy head of audit delegation, head of audit delegation, chief auditor.

8. Authority to impose fines and apply measures to remedy consequences: Article 16 of the law provides for the authority of the head of the audit delegation and the chief auditor in imposing fines and applying measures to remedy consequences.

9. In terms of filing complaints and lawsuits regarding administrative violations in the field of state audit: Article 7, Clause 2 of the law regulates the procedures for filing and resolving complaints against administrative penalties, as well as the rights to institute a lawsuit and resolve complaints of individuals and organizations that have been penalized.