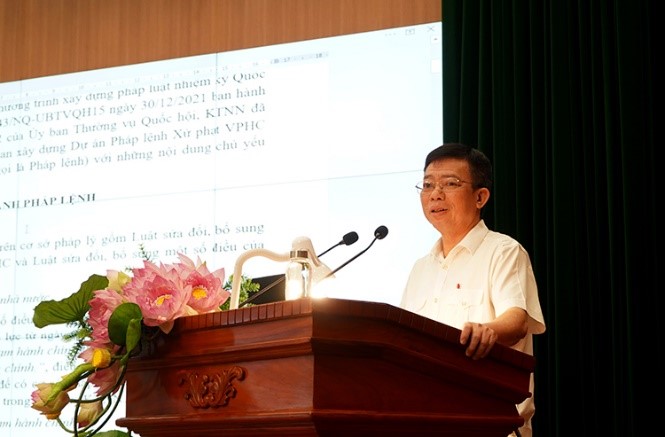

The State Audit Office of Viet Nam (SAV) held a conference on May 10, 2023 to disseminate information about the Ordinance ('Ordinance") on Administrative Sanctions for Violations in the field of State Audit. Taking place at SAV headquarters located at 116 Nguyen Chanh, Ha Noi, the event was attended by officials, civil servants, and employees from executive units, public services units, Office of the Party and Association and Regional State Audit Offices.

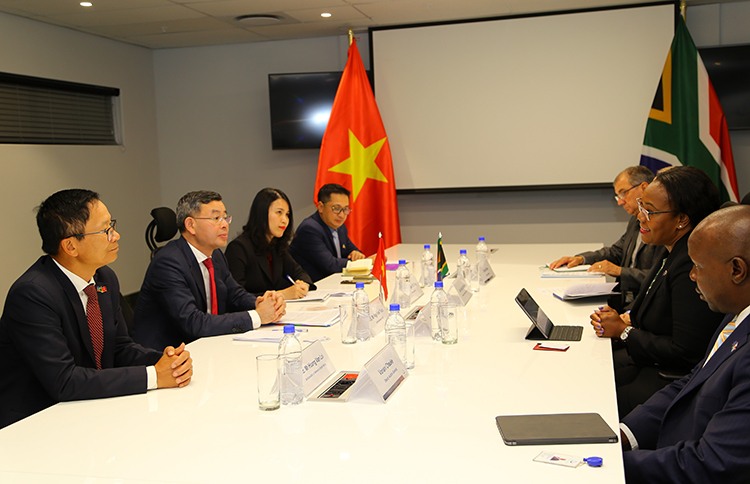

The State Audit Office of Viet Nam (SAV) delegation led by Member of the Party Central Committee, Auditor General Ngo Van Tuan had a working session with AGSA of Western Cape - the legislative capital on April 21st, 2023 during their visit to South Africa from April 16th to 23rd, 2023

The State Audit Office of Viet Nam (SAV) delegation led by Deputy Auditor General Dr. Ha Thi My Dzung, paid a working visit to New Zealand and Australia from April 14-23, 2023. As part of their trip, the delegation attended IMPACT 2023 – the International Meeting of Performance Audit Critical Thinkers held on April 19-20, 2023. The event was hosted by the Australian National Audit Office (ANAO) in collaboration with the ACT Audit Office and featured over 200 delegates from Supreme Audit Institutions (SAI), relevant Australian ministries and sectors as well as leading international experts.

In the morning of April 17, 2023, in Wellington, New Zealand, the State Auditor General of New Zealand Mr. John Ryan held a courtesy meeting and worked alongside with the delegation from the State Audit Office of Viet Nam (SAV) led by SAV’s Deputy State Auditor General Mrs. Ha Thi My Dzung

At the invitation of the INTOSAI Development Initiative (IDI), Deputy Auditor-General Doan Anh Tho participated in the Leadership Master Class (MASTERY): “Supreme Audit Institutions (SAIs) and Public Financial Management: Foresight Exercise” in Manila, Philippines from May 3rd to 5th, 2023. Attending the course were 10 Auditors-General of Supreme Audit Institutions (SAIs) from the Philippines, Palestine, Pakistan, Tuvalu, the Federated States of Micronesia, the Maldives, the Solomon Islands, Suriname, the Cook Islands, the Federation of Saint Christopher and Nevis.

At the invitation of Ms. Tsakani Maluleke, the Auditor General of South Africa, the delegation of the State Audit Office of Viet Nam (SAV) led by Mr. Ngo Van Tuan, Member of the Party Central Committee, SAV’s Auditor General paid a working visit at the South African Republic during 16-21 April 2023. Vietnamese Ambassador to South Africa Hoang Van Loi attended the meeting at the AGSA Office.

At the request of Deputy Auditor General Ha Thi My Dzung, in order to solve difficulties in accessing and collecting public audit data, SAV’s Working Group on Information Technology (IT) Application should proceed with specific and right-purpose steps through the clear, thorough and effective methods.

On April 7, 2023, at the headquarters of the State Audit Office of Viet Nam (SAV), Mr. Ngo Van Tuan – Member of the Central Party Committee, Auditor General of SAV chaired the 2nd quarterly meeting in 2023. Attending the meeting were Deputy Auditors General Nguyen Tuan Anh, Doan Anh Tho and Ha Thi My Dzung and leaders of SAV units.

Auditor General Ngo Van Tuan, member of the Party Central Committee, recently signed Plan No. 269/KH-KTNN on "Preventing and combating corruption, negativity in 2023."

Auditor General Ngo Van Tuan has recently signed Decision No. 299 /QD-KTNN on promulgation of the Regulation on management, exploitation and use of the web portal of the State Audit Office of Viet Nam (SAV).